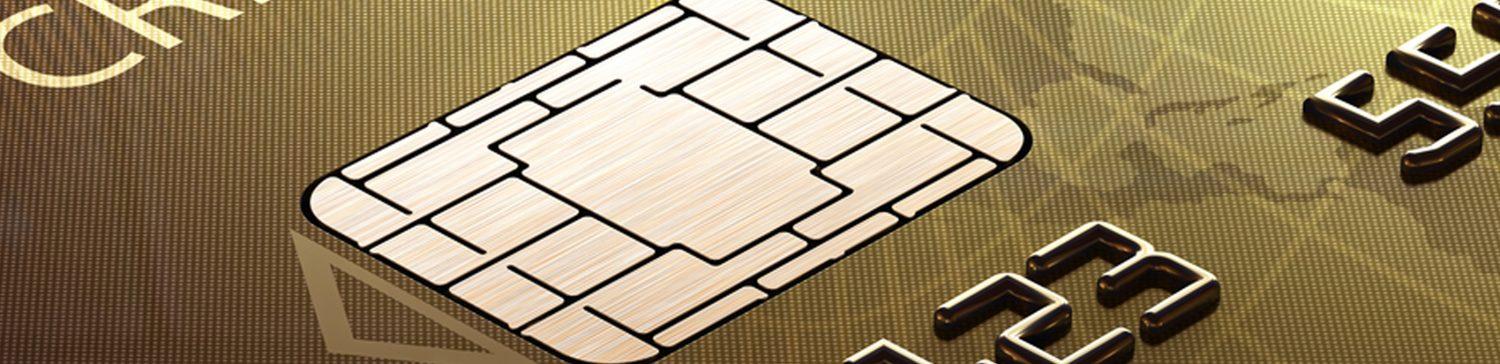

Want to learn how to keep your money safer? In today’s economy, credit card theft is very often and it’s easy for hackers to get ahold of your information. Businesses have created a new system for reading everyone’s personal information, so banks are transferring all their customers to smart chip credit cards. The credit cards banks are sending out contain a magnetic strip and a chip, because some places will not have just a chip reader.

The deadline for businesses and banks to transfer over to a chip-reading payment method is Oct. 1, 2015, while banks are sending out chip enables cards to all their clients as soon as possible. Businesses that do not have chip reading technology by October 2015 will be much more liable.

Smart chip credit cards are often underestimated by people because they don’t understand how they work. To use this payment method, the consumer has to insert their credit card vertically into a slot at the bottom of a credit card reader and either enter their pin or sign their name. The card will remain in the reader for the duration of the transaction, until the swiping method. Some card readers have both the swiper and the chip reader due to the timeliness of consumers transferring over to the chip. Depending on the reader, you may be asked to swipe your card and use the chip reader for one transaction.

“Working at Marshalls I think that this system is very cool and efficient because you don’t have to enter your pin, you just sign it and that’s it. It’s faster and easier for customers to pay,” senior Ada Torres said.

The reason why this method is any different than just swiping your credit card is because the way the system reads the information. Hackers had easy access to recent customers bank accounts due to the magnetic swipe information they could gain from one swipe.

Top image: Google