In 2021, Marco Villarreal resigned as Caterpillar’s director general in Mexico and began nurturing ties with companies looking to shift manufacturing from China to Mexico. He found a client in Hisun, a Chinese producer of all-terrain vehicles, which hired Villarreal to establish a $152 million manufacturing site in Saltillo, an industrial hub in northern Mexico.

Villarreal said foreign companies, particularly those seeking to sell within North America, saw Mexico as a viable alternative to China for several reasons, including the simmering trade tensions between the United States and China.

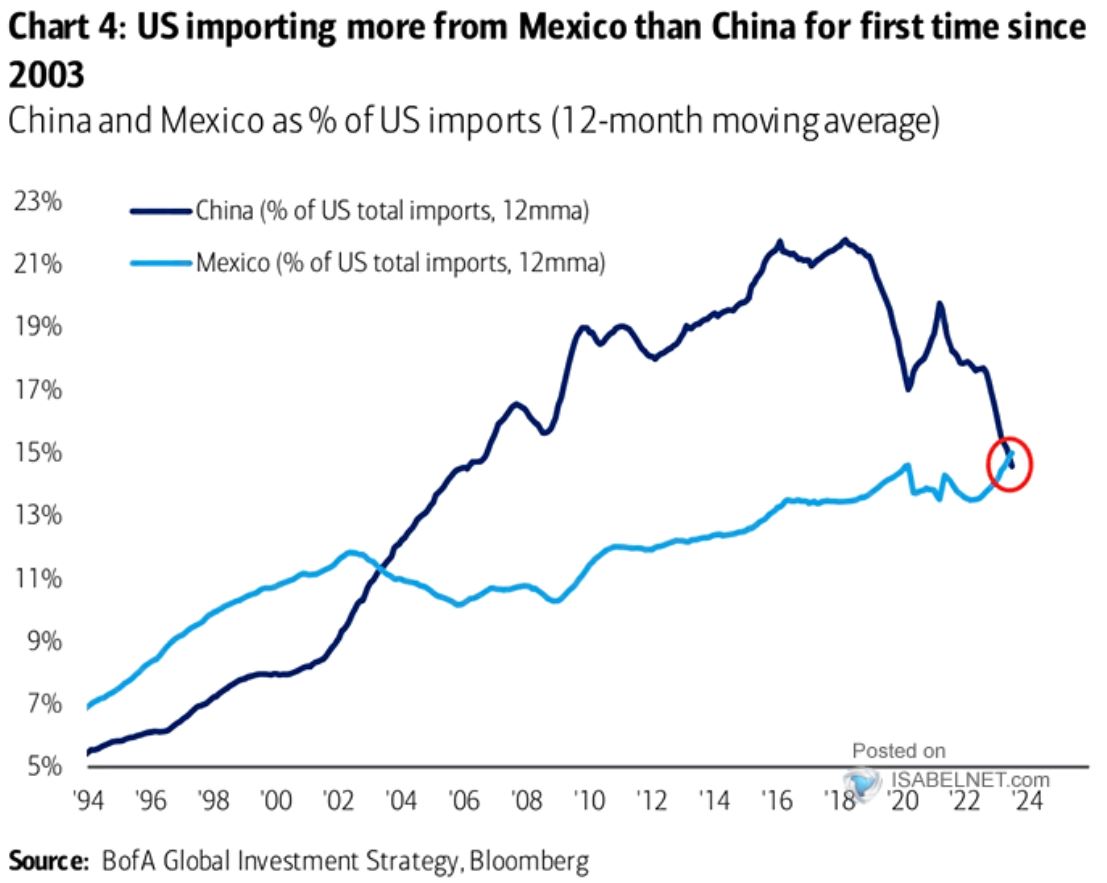

New data released on Feb. 6 showed that Mexico outpaced China for the first time in 20 years to become America’s top source of official imports, a significant shift that highlights how increased tensions between Washington and Beijing are altering trade flows.

The United States’ trade deficit with China narrowed significantly last year, with goods imports from the country dropping 20 percent to $427.2 billion, the data shows. American consumers and businesses turned to Mexico, Europe, South Korea, India, Canada and Vietnam for auto parts, shoes, toys and raw materials.

Mexican exports to the United States were roughly the same as in 2022, at $475.6 billion.

America’s total trade deficit in goods and services, which consists of exports minus imports, narrowed 18.7 percent. Overall U.S. exports to the world increased slightly in 2023 from the previous year, despite a strong dollar and a soft global economy.

U.S. imports fell annually as Americans bought less crude oil and chemicals and fewer consumer goods, including cell phones, clothes, camping gear, toys and furniture.

The recent weakness in imports, and drop-off in trade with China, has partly been a reflection of the pandemic. American consumers stuck at home during the pandemic snapped up

Chinese-made laptops, toys, Covid tests, athleisure, furniture and home exercise equipment.

Even as concerns about the coronavirus faded in 2022, the United States continued to import a lot of Chinese products, as bottlenecks at congested U.S. ports finally cleared and businesses restocked their warehouses.

“The world couldn’t get access to enough Chinese goods in 2021, and it gorged on Chinese goods in 2022,” economist and senior fellow at the Council on Foreign Relations Brad Setser said. “Everything has been normalizing since then.”

But beyond the unusual swings in annual patterns in the last few years, trade data is beginning to provide compelling evidence that years of heightened tensions have significantly chipped away at America’s trading relationship with China.

In 2023, U.S. quarterly imports from China were at roughly the same level as they were 10 years ago, despite a decade of growth in the American economy and rising U.S. imports from elsewhere in the world.

The shifting trade dynamics between the United States and its global partners, particularly the notable increase in imports from Mexico compared to China, reflect a nuanced evolution in economic relationships. This trend underscores the adaptability and resilience of international trade networks, and it will be interesting to observe how this dynamic continues to shape economic ties between these nations in the future. As geopolitical and economic landscapes evolve, the United States’ strategic choices in trade partnerships will likely continue to be a subject of keen observation and analysis.